Why Self-Custody is the Future of Crypto: Taking Control in a Trustless World

Learn why holding your own keys is more than a technical choice—it's a powerful act of financial sovereignty, freedom, and trust in yourself over institutions.

By Obafunso Ridwan, Joseph Samuel, Akin Ebenezer

May 12, 2025

You’ve spent years saving money in a bank, only to wake up one day and find the doors locked, your life’s savings frozen. For many, this nightmare became reality during the 2008 financial crisis. Fast-forward to today, and a similar story is unfolding in crypto—except this time, we have a choice.

Self-custody—holding your own crypto keys instead of entrusting them to exchanges—isn’t just a technical buzzword. It’s a revolution in how we think about ownership, freedom, and trust. And it’s quietly becoming the backbone of crypto’s future. Here’s why.

"Not Your Keys, Not Your Crypto" Isn’t Just a Meme—It’s a Warning

Crypto was born from a rejection of centralized power. Satoshi’s whitepaper wasn’t just about digital money; it was about self-sovereignty. Yet, ironically, many of us still hand over our Bitcoin and Ethereum to centralized exchanges (CEXs) like we’re depositing cash at a bank.

The problem? History keeps repeating itself. FTX’s collapse, Celsius’ bankruptcy, and countless exchange hacks have left users empty-handed. When you store crypto on an exchange, you’re not really holding it—you’re trusting a middleman. And as the saying goes: “If you don’t hold your keys, you don’t own your crypto.”

Self-custody flips the script. It’s like keeping cash in your wallet instead of a vault owned by strangers. Yes, it requires responsibility—losing your keys means losing access forever—but it also means no one can freeze, seize, or gamble away your assets.

Freedom From Permission

You want to send money to a friend in another country. With a bank, you’d face delays, fees, and questions. With crypto on an exchange, you might hit withdrawal limits or wait for approval. But with self-custody? You click send. That’s it.

Self-custody removes gatekeepers. No one can block your transactions because of your politics, nationality, or “suspicious activity.” It’s money that’s truly yours, moving at the speed of the internet. For people in authoritarian regimes or unstable economies, this isn’t just convenient—it’s life-changing.

The Emotional Shift: Trust Yourself, Not Institutions

Let’s be real—trust in traditional finance is eroding. Inflation, surveillance, and arbitrary rules have left people disillusioned. Crypto’s promise was always about empowerment, but relying on exchanges just recreates the old system with a crypto logo.

Self-custody is a mindset shift. It’s admitting, “I don’t need a custodian to protect my wealth”. For some, that’s terrifying. For others, it’s liberating. As more people experience hacks or exchange defaults, the emotional appeal of control grows stronger.

The Road Ahead: Challenges and Hope

Self-custody isn’t perfect. Human error—lost recovery phrase, phishing scams—remains a hurdle. But the answer isn’t to shy away; it’s to educate. Crypto’s true adoption will come when grandma can safely hold her own keys, not when CEXs dominate.

Regulators may push back, fearing loss of control. But the genie is out of the bottle. Every time an exchange fails, more people migrate to self custody wallets. Every privacy scandal drives home the value of autonomy.

Conclusion: The Future is in Your Hands

Crypto’s biggest irony is that its ethos of decentralization got lost in the rush to get rich. Self-custody is the correction we need—a return to the original vision of peer-to-peer, trustless systems.

This isn’t just about avoiding the next FTX. It’s about reclaiming the power to own, move, and protect what’s yours—no middlemen, no excuses. The future of crypto isn’t in the hands of Silicon Valley CEOs or Wall Street hybrids.

It’s in your hands. Literally.

Share Article

Related Article

Defi

HD Wallets: The Smarter Way to Manage Multiple Wallets with One Backup

July 20, 2025

Obafunso Ridwan, +2

Defi

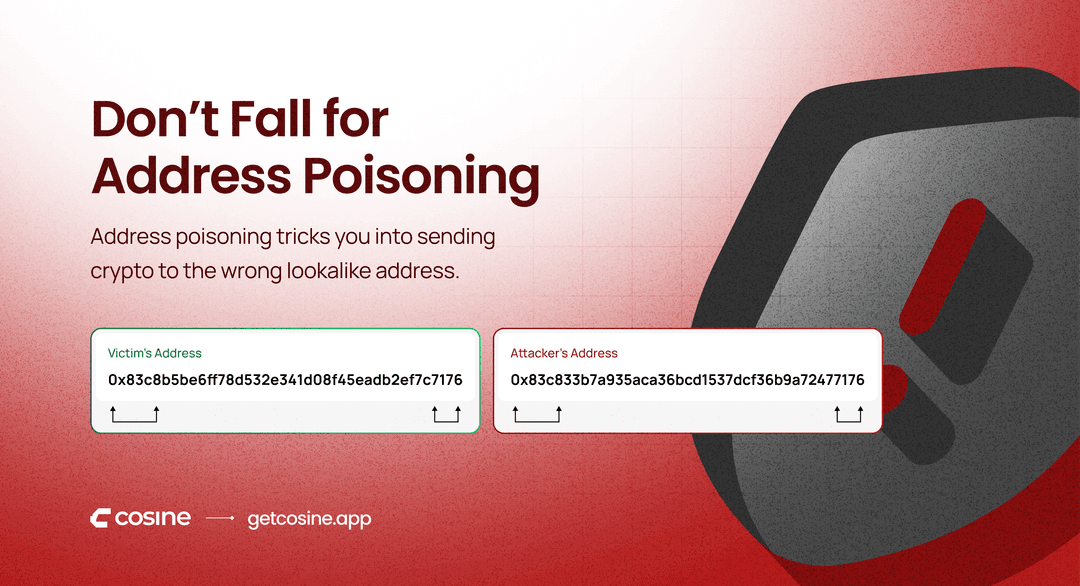

Address Poisoning in Crypto: What It Is, How It Works, and How to Stay Safe on L2 Networks

July 02, 2025

Obafunso Ridwan, +2